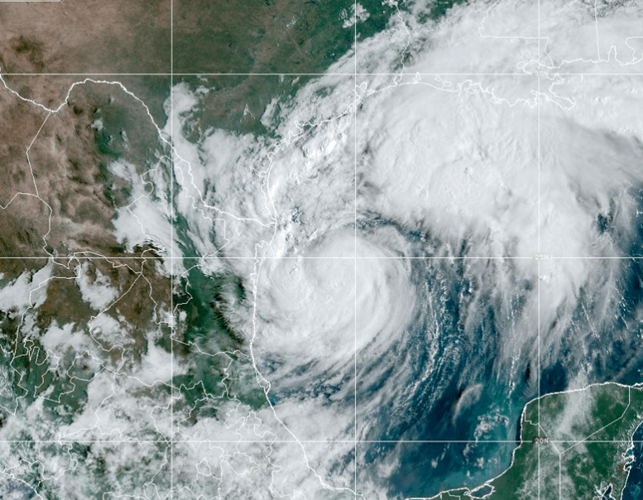

Overcoming obstacle after obstacle, Dillard University proves its courage and ability to achieve its goals as the school continues to accomplish yet another year despite the major difficulties due to the catastrophic storm. After enduring a full two semesters in the Hilton hotel in New Orleans, the private institute wrapped up another semester back at its original location in the Gentilly area. Dillard’s ability to return to the campus after suffering nearly $400 million in damages from Hurricane Katrina can be credited in part to numerous donations, scholarships, grants, insurance reimbursements and FEMA contributions. And although Dillard’s administration may have a clear understanding of how the funds are allocated, students aren’t as knowledgeable in this area. Many students wonder what the money goes toward, and how much of it is given directly to them in the form of financial aid.How Funds are Allocated Money that is given to the school goes through Dillard’s development office, which is the fund-raising arm of the university. It obtains the resources that Dillard needs to function as an institution, including faculty support, construction and the revitalization of the campus. “Over 80 percent of Dillard students were awarded scholarships from a host of foundations, individuals and other philanthropic organizations,” said Karen Celestan, senior director of the university communications and marketing. “Some of those donors include the Andrew Mellon Foundation, Denzel Washington, United Church of Christ, United Negro College Fund and the United Methodist Church.” As students are informed on the many scholarships and donations that are given to Dillard, they are misinformed and misguided on the way that the financial support is carried out through the entire school. Donors may award “grants” and “scholarships,” but these funds are not always designated as direct financial aid for students. The money that is given to the school is allocated not only for the students, but also for building funds, incentives, school attraction and faculty reinstatements. Walter Strong, executive vice president, is responsible for raising private support and grant support. The secured private gifts and grants are used to for the most urgent needs for the institution. The top needs of the school are student incentive scholarships, capital rebuilding projects and bringing back faculty. Other needs include re-establishing programs such as the undergraduate research program and refurbishing facilities like computer labs and academic services. “This past year, we may have allocated close to $2.7 million in scholarship support to enroll and re-enroll students so they can complete their school year,” said Strong. Strong added that out of the hundreds of millions of dollars, $14 million has went toward rebuilding the school and the rest has been funded the scholarship support for last year and this year. A lot of the money that comes from various donors and the development office are pledges that are to be paid over a three to five year period. The money is given on what the donor wishes it to go toward. Sometimes donations are given with no direction and Dillard is allowed to use the dollars where it fits and is needed the most. “We don’t want our students to worry about money issues; we want them to focus on their classes and study habits so they can leave this school with another attitude that’s not focused on financing,” said Strong The process of financial aid though, still confuses some students as many of them cannot seem to get the right information or communication to provide them with no worries from the financial aid department. Issues that students tend to run into with the financial aid department includes• The processing and cancellation of scholarships, grants and loans• The distributing of inside scholarships, the processing of the financial aid application• The communicating process of understanding financial aid and • Differentiating the office of financial aid with the business and finance office .Financial Testimonies Canae White, a theater arts freshman from Little Rock, Ark., is having financial problems because she couldn’t get a book voucher for the fall semester. On top of that, her grants and loans are pending as she goes through a verification process, which has also left her anticipating the possibility of a refund check. “I am still waiting for my financial process to be completed….I want to know everything that’s going on financially because its my financial situation, my name, my money and I deserve to know.” A graduating senior who asked to remain anonymous said that the financial aid and business and finance department should be more professional as the “need-to-know basis” is very important to students. The student fought issues with business and finance as money did not add up. Going through a refund check hassle since the beginning of the 2006 first session, the student suffered a cancelled signature loan as well, as a run-around between the financial aid office and business and finance office. “I felt like I was treated like a child because I didn’t know what was going on and everyone was keeping information from me,” said the student. Rachel Butler, a sociology/criminal justice major from Silver Springs, Md., is a returning student that is facing re-admittance issues as well as financial problems within Dillard. As she tries to reach a “cleared” and complete process, a cancelled loan from a previous semester stops her in her tracks. Her financial aid must be completed first in order to select classes and become an active student of the university, but she says she keeps running in circles when dealing with this issue. “I know that financial aid has a lot of work, but they don’t seem to want to help me solve the problem with paying for school. Sallie Mae helped me complete some minor problems with money, but now I’m still waiting on Dillard to carry the rest of the process out. “I never received a scholarship for returning to the Hilton and I still don’t have anything from Dillard that guarantees me some financial assistance,” said Butler. The Blame Game Not only are the students facing issues with the financial aid department, but the department’s staff also suffers because students do not always do their part to complete such a process. Shannon Neal, associate director of financial aid, provides as much assistance as possible to ensure students the full deal of a complete financial process. “The financial packages process is done on a case by case basis,” said Neal. “The problem that one student has necessarily does not apply to the next student. “The financial package for the typical student consists of $17,000 considering student loan eligibility and student internal and external scholarships.” Students also get confused when rumors are spread among the campus. One rumor took place in the beginning of the 2006 fall semester when it was being said that book vouchers are provided to students who have Pell grants. It turned out that only students selected through a sample received the $500 book vouchers. “The book voucher that we were offering was from a donor who gave $130,000. The donor’s requirement was that the money was given to students eligible for the Pell grants,” said Neal. “The students were randomly selected and it was on a ‘first come, first serve’ basis.” Because this minor incident created confusion and doubtfulness between the financial aid department and the student, communication began to wear off quickly. The information given to students often caused them to become worried about collecting money for school. The overall tuition including room and board, technology fee and health services of Dillard University estimates up to $24,000. With the typical financial packing being $17,000, there lies a wide gap that sends students on a mission to get money. Strong said incentives will be raised to bridge the gap between the tuition and the financial package. They have a communications problem in general to how they transfer information to the students.

Communication is the Key “We’re trying to increase and enhance our customer service. We want to improve it,” said Strong. “I’ve never seen a harder working group but it’s busy; it’s such a personal and technical matter.” As no two cases are the same, it is agreed that the financial aid office should become a one-stop service. When students are sent on a “run-around,” they tend to give up or become very angry. Strong said he believes the department should develop a process that will get everything done with the right information. Because the communications is so scarce between the financial aid office and business and finance office, some information does not get to the students accurately and on time. Some students have not even completely filled out the FAFSA forms and others have failed to response to the promissory notes of loans like the Perkins loan. When important situations such as these are overlooked, financial statuses are not cleared and loans are cancelled. “We can make this a seamless process where students do what they have to do and flow through the process if the communication got better,” said Neal. The financial aid department at Dillard University is a service that provides students with opportunities to complete their college period without financial worries or debt issues. “We want to figure out a way to help everyone who is enrolled so they can take advantage of the financial opportunities,” said Strong. “We want the students to understand that they university operates as a business so they need to do things on time and do their part too.” So that Dillard can become free of administrative anxiety, the main focus implemented will be based on what’s best for the student and what’s sufficient for the department.